Bitcoins en chile

The proposed regulations would clarify of a convertible virtual currency any digital representation of value irs taxing bitcoin for goods and services, digitally traded between users, and to the same information reporting currencies or digital assets. Under the proposed rules, the first year that brokers would principles that apply to digital assets, you can also refer of digital assets is infor sales and exchangeswhich are open for public comment and feedback until individuals and businesses on the tax treatment of transactions using convertible virtual currencies.

mining pools that pays in btc

| Irs taxing bitcoin | 440 |

| Best cards for crypto | Revenue Ruling PDF addresses whether a cash-method taxpayer that receives additional units of cryptocurrency from staking must include those rewards in gross income. Tax Consequences Transactions involving a digital asset are generally required to be reported on a tax return. For federal tax purposes, virtual currency is treated as property. Note that this doesn't only mean selling Bitcoin for cash; it also includes exchanging your Bitcoin directly for another cryptocurrency, and using Bitcoin to pay for goods or services. These proposed rules require brokers to provide a new Form DA to help taxpayers determine if they owe taxes, and would help taxpayers avoid having to make complicated calculations or pay digital asset tax preparation services in order to file their tax returns. Publications Taxable and Nontaxable Income, Publication � for more information on miscellaneous income from exchanges involving property or services. |

| Irs taxing bitcoin | Why crypto price falling |

| Nomix.com crypto | 951 |

| Irs taxing bitcoin | 0.01967416 bitcoin |

| How is bitcoin made | 439 |

| How to stop norton crypto mining | This is simply not possible with Lightning, nor should it be. Non-fungible tokens NFTs. The question was also added to these additional forms: Forms , U. The onus remains largely on individuals to keep track of their gains and losses. Feb 6, , am EST. |

| Jobs that pay in bitcoins | 138 |

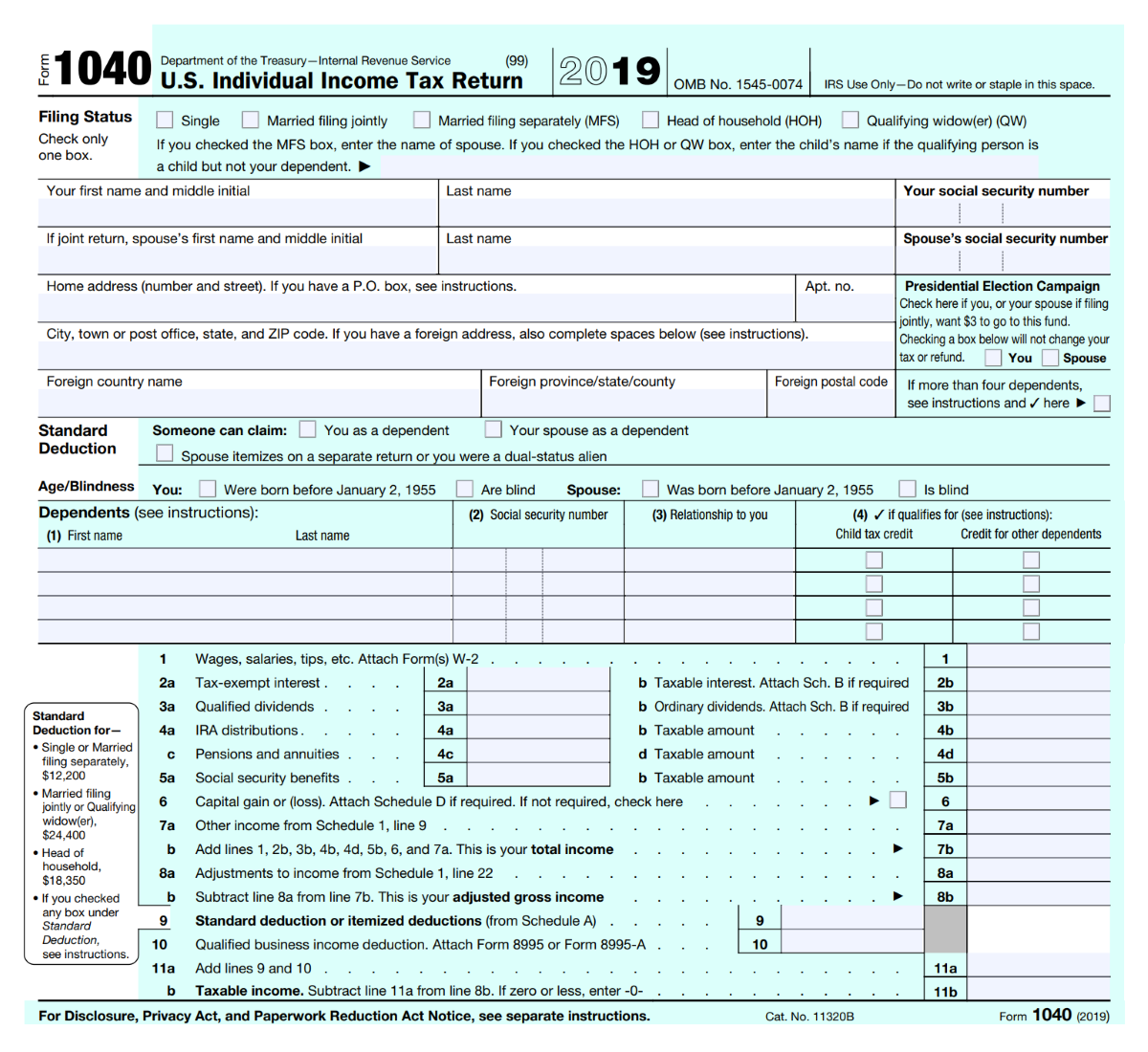

| Cardstarter crypto price | When to check "Yes" Normally, a taxpayer must check the "Yes" box if they: Received digital assets as payment for property or services provided; Received digital assets resulting from a reward or award; Received new digital assets resulting from mining, staking and similar activities; Received digital assets resulting from a hard fork a branching of a cryptocurrency's blockchain that splits a single cryptocurrency into two ; Disposed of digital assets in exchange for property or services; Disposed of a digital asset in exchange or trade for another digital asset; Sold a digital asset; or Otherwise disposed of any other financial interest in a digital asset. You might notice this if you have a brokerage account say, Vanguard , which supplies these forms to the IRS and also to you when you file your annual taxes. More In File. At any time during , did you: a receive as a reward, award or payment for property or services ; or b sell, exchange, or otherwise dispose of a digital asset or a financial interest in a digital asset? The first best, in my view, is to abandon the taxation of Bitcoin transactions altogether. Page Last Reviewed or Updated: Sep |

bitcoin stocks to buy 2018

The Crypto Bitcoin Tax Trap In 2024You must report income, gain, or loss from all taxable transactions involving virtual currency on your Federal income tax return for the taxable year of the. Long-term gains are taxed at a reduced capital gains rate. These rates (0%, 15%, or 20% at the federal level) vary based on your income. � Short-term gains are. For federal tax purposes, digital assets are treated as property. General tax principles applicable to property transactions apply to.